The Fourteenth Banker writes today:

In the stock market, program trading dominates volume. I heard recently that 70% of trade positions are held for an average of 11 seconds.

He's definitely correct....

http://www.kitco.com/ind/willie/oct212010.html

As the New York Times dealbook noted in May:

These are short-term bets. Very short. The founder of Tradebot, in Kansas City, Mo., told students in 2008 that his firm typically held stocks for 11 seconds. Tradebot, one of the biggest high-frequency traders around, had not had a losing day in four years, he said

Similarly, FT's Martin Wheatley pointed out last month:

I know of one HFT firm operated out of the west coast of the US that boasts its average holding period for US equities is 11 seconds

And market analyst Peter Cohan writes at AOL's Daily Finance:

70% of trading volume on the major exchanges is conducted by high-frequency traders who hold a stock for an average of 11 seconds.

But as Tyler Durden points out, alot can happen in 11 seconds when the players are high-powered computers:

BATS "Flag Repeater". 15,000 quotes in 11 seconds, dropping the ASK price 1 penny each quote from $9.36 to $8.58 and back up again...It seems to me that all this could have been corrected long ago by simply making the definition of investment for tax purposes require that you hold the security for a minimum of one year. Any thing less than that would be considered a gambling win or loss and would be treated for tax purposes the same way as winnings on the roulette tables in Vegas. http://republicbroadcasting.org/?p=11579

Of course, no "serious" person wants to fix this because they don't view it as a problem. 11 seconds - hey that's a vital investment and gives a person (usually a corporate person) more rights and privileges over that company than the people who have worked 30 years in its offices or factories. What could be wrong with that?Sounds like a game of hot potato, hot potato....and utter corruption to the core....Fraud, Fraud and more FRAUD in USA...

http://www.youtube.com/watch?v=xCassMy2frI&feature=related

The Chances of a War with China are Rising : ????

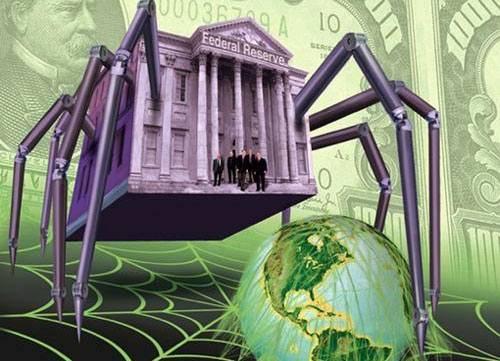

The United States conducts monetary policy the same way it conducts foreign policy; unilaterally. When Fed chairman Ben Bernanke signaled last week that he was planning to restart his bond purchasing program (Quantitative Easing) he didn't consult with allies at the IMF, the G-20 or the WTO. He simply issued his edict, and that was that. The fact that the Fed's policy will flood emerging markets with cheap capital, pushing up the value of their currencies and igniting inflation, is of no concern to Bernanke. He operates on the same theory as former Treasury Secretary John Connally who breezily quipped to a group of euro finance ministers, “The dollar is our currency, but your problem.”

http://www.archive.org/details/SevenFinancialConspiraciesWhichHaveEnslavedTheAmericanPeople

MERS, Fraud and more Fraud in California and all over USA....Former hedge fund manager Shah Gilani notes:

In creating MERS, these institutions actually changed the land-title system that this country - for much of its history - has relied upon to determine legal ownership status of land titleholders.MERS is a shell company, with no employees. However, its parent does have employees.

Not only did the lenders sidestep (read that to mean avoid) paying billions of dollars in fees to local governments, they paid themselves from the fees that MERS collected.

MERS is facing class-action lawsuits and civil racketeering suits around the country and their members are being individually named in all these suits. One suit alleges that MERS owes California a potential $60 billion to $120 billion in unpaid land-recording fees.

If suits against MERS and all its members are successful, unpaid recording fees and fines (that can be as much as $10,000 per incident) would make every one of them insolvent.

As Bloomberg notes:MERS Inc., which holds the liens, has no employees, and MERSCORP, the parent, has only about 50, [the MERS spokeswoman said].Plaintiffs' lawyers will undoubtedly argue that the "corporate veil should be pierced". In other words, they'll argue that MERS hasn't followed normal corporate formalities, and so the big banks which own it should have to pay any judgments against it.

I am not sure who will win that argument.

But Plaintiffs' lawyers will probably also name the banks directly as co-defendants.Political priorities are not always already embedded in the economic “clean” analysis of the utterly corrupt USA?

Lets not minimize a major point which the MSM tries to pooh pooh away with reference to health spending etc…. Had the US have spent the trillions of dollars after the barbaric inside Job of 9/11 on serious and effective AIPAC Free....Congressional Inquiries....about this monstrous covert operation of the Deep State in USA....and some global police action, cooperation, development, security sector reform and strengthening in the US and devoted some of those resources – and the political capital after "9/11"...... – to solving some of the core grievances…. Well… where would we likely be now? This is an opportunity cost question which cannot be separated from any supposedly “real” and un-politicized accounting of the track which was in fact taken and which now threatens to tip USA interests and power further over the edge....and off the Cliff for Good....

Today, Whalen provides further details:

The short answer is "innovation." In her column, "One Mess That Can't Be Papered Over," Gretchen Morgenson of the New York Times reveals the practice in FL and other jurisdictions of destroying the physical note. We really like the 4th from last paragraph, the one about the standard practice of Florida bankers to destroy the original note when an electronic form was created, to "avoid confusion." If you know anything about the checkered history of FL real estate over the past century, this one bites you in the leg.

Is it just possible that creative Florida bankers discovered they could "sell" mortgages many times by conveniently delivering a "copy" of the electronic note for each subsequent sale? By delivering a "good" electronic note to each purchaser, the seller/servicer could kite the Ponzi scheme to the sky -- using the proceeds from each sale to pay interest to each new group of investors. As we told [Washington's Blog] in the failure of First National Bank of Keystone , management hid a Ponzi scheme in the loan servicing area for years, fooling regulators and internal auditors (See 'Audit Risk: Grant Thornton & The Keystone Saga', January 29, 2007) .

***

We know people in the servicing sector and related legal specialties who think that the fraud perpetrated upon investors and insurers due to multiple pledges of collateral could be massive. It is also, conveniently enough, another reason for the Obama White House and Fed to continue to prop up the top-three banks with significant GSE exposure -- and the mortgage insurers that help window dress the GSEs already horrible losses.

October , 2010

UNITED STATES of America - It can now be reported that German Chancellor Angela Merkel recently confronted both U.S. Treasury Secretary Timothy Geithner and Federal Reserve Chairman Bernard Bernanke at the G-20 Economic Conference in Gyeongju, South Korea.

Merkel accused both Geithner and Bernanke of blatant manipulation of the EURO currency on the behalf of foreign currency derivatives currently held by noted criminal brokerage firms aka banks Goldman Sachs and Bank of New York Mellon, as well as Warren Buffet's Berkshire Hathaway.

German Chancellor Angela Merkel (L), Federal Reserve Chairman Bernard Bernanke and U.S. Treasury Secretary Timothy Geithner AP

Merkel presented 'smoking gun' evidence supplied to her by European INTERPOL in Brussels, Belgium to Geithner and Bernanke that the U.S. Fed used secret offshore hedge funds controlled by Goldman Sachs in Singapore, Australia and Dubai to inject billions of fiat dollars and Japanese Yen into the overnight forex aka foreign currency markets that artificially lifted the value of the EURO currency against the U.S. dollar while simultaneously boosting the price of gold and crude oil futures contracts...

This financial Black Op title "Flush the Toilet", (a plot to depreciate the value of the U.S. currency), which was enabled by the Central Bank of Japan, utilized a form of electronic order entry from the aforementioned trading platforms called 'high frequency trading'. This sophisticated technology, which is a high bred spin off of the noted PROMIS software technology, enabled the Federal Reserve, along with the criminal brokerage firms Goldman Sachs and Bank of New York Mellon, to get a 3 to 5 second lead time on all electronic currency orders.

This financial black op was also enabled by the corporate-controlled, fascist, extortion-friendly U.S. media, which bombarded the American People, along with the rest of the world, with a 24-hour blitzkrieg of alleged terrorist threats...

Again, folks, there is NO war on terror, there NEVER has been a war on terror. There has been a war directed on the American People and their Constitution by the criminal financial elite that occupy the United States. Once you have read this intelligence briefing, folks, you will understand, again, who the REAL terrorists are....

Believe it or not, this electronic high frequency trading allows the criminal banking elite to take advantage of what is called a forex spread on foreign currency transactions, which allows them to widen the spread and actually be on both sides of the market at the same time. This is called, folks, in layman's terms "electronic bucketing".

Reference: While all of this criminal financial chicanery continues the alleged government financial oversight agencies aka the SEC, etc. ignore all of this criminal misconduct by the criminal banking elite (like they ignored the criminal activity of the Madoff and Stanford Ponzi Schemes....both closely linked to CIA/MOSSAD covert operations.....slush-funds) and, instead, are declaring war on small retail brokerage houses utilizing illegal, UN-Constitutional phone tapping and entrapment methodology. Their modus operandi is to accuse the retail brokerage house of charging excessive commission aka you charge the customer $50 not $45.

Listen to this, folks. Most of the high level board members who represent these government financial regulatory oversight agencies are linked to none other than the criminal banking interests aka Goldman Sachs and Bank of New York Mellon that have LOOTED the U.S. Treasury and then got 'bailed out' for doing it.

Message to criminal banking elite: Your job is simple, don't make it complicated. You are entrusted with the deposits and life savings of your customers to be protected. Other than that your role should be to loan money for the purchase of automobiles and homes. It is clear now that you can not be trusted to do anything else.

Question for the day: What is an investment banker? An investment banker is a whore and the current regulatory agencies are their pimps.

Note: There is no paper trail on electronic trading in overseas markets or offshore hedge funds.

This derivative daisy chain is tied to these numerous U.S. criminal banks aka financial terrorists, who were originally bailed out by the former illegal BushFRAUD Administration with the assistance of current U.S. Speaker of the House Nancy Pelosi aka Nancy Ponzi.

Item: Both BushFRAUD and Nancy Ponzi threatened the U.S. Congress at the time that if they did not 'bail out' these criminal banking interests with U.S. Taxpayers' money a state of "Martial Law" would be declared on American soil.

After receiving their UN-Constitutional 'bail out', these criminal banks, with the assistance of U.S. Taxpayers' money aka TARP, continued their illegal proprietary derivative trading, which continues to this day with the full blessing of the puppet Obama Administration.

P.S. The current derivative holdings of the Fed as well as Goldman Sachs and Bank of New York Mellon are just a spin off of the original toxic assets and derivatives that almost destroyed the U.S. economy in September of 2008. These are actually the same derivatives that were tied to the original 2008 'bail out' of the original Bank of America assisted 2008 'bail out' of Bear Stearns.

All Bank of America has done since 2008 is to compound these toxic mortgage-backed securities derivatives, use them as alleged margin to trade forex foreign currencies, and now create a new foreclosure fiasco that will then call for another 'bail out' all financed by the U.S. Taxpayers' money.Reference: Former U.S. Treasury Secretary Henry Paulson aka former CEO of Goldman Sachs (the mastermind of the Bank of America bail out of Bear Stearns) was supposed to use the original TARP funds to buy up toxic assets and clean up the books of these criminal banks. Instead, Paulson and the BushFRAUD Administration bailed these thugs out and basically presented them with TRILLIONS of dollars of free money that they continue to use for proprietary trading.

Current U.S. Secretary Treasury Timothy Geithner continues to enable this outrageous criminal activity that is taking place with these banks and is now nothing but a bag man for Federal Reserve Chairman Bernard Bernanke.

Let us make it clear, folks. These criminal banks aka "financial terrorists" never cleaned up their own books, received free money aka U.S. Taxpayers' money from the American People and continue to engage in a massive worldwide ponzi scheme that is a dead end and a road to financial ruin.

P.P.S. When you hear financial reports on the news media like Bloomberg News, CNBC or Zionist controlled CNN.... (nothing but a front for the conspiratorial Federal Reserve...), about more "quantitative easing" that the Federal Reserve alleges will stimulate the U.S. economy it is nothing but BULLSHIT!

Quantitative easing is nothing more than a continued 'bail out' and propping up of these corrupt financial institutions(still loaded up with toxic asset derivatives) that have LOOTED the U.S. Treasury and reduced America to a banana republic.

Message to President Obama: If you are going to spend a trillion dollars to revive the U.S. economy you may want to create Roosevelt-type era actual jobs on American soil, like a national high speed rail system, long overdue.... and eliminate the U.S. payroll tax....

No comments:

Post a Comment