Jim O’Neill, the Goldman Sachs analyst who came up with the term “BRIC” a decade ago, has cooked up a new, catchy investment theme. Get ready for the “N-11”, shorthand for the “New 11”, a gaggle of early stage emerging markets who will become the inheritors of the BRIC’s high growth rates. The basic idea is to surf a global wave of coming GDP and per capita income rises. The N-11 breaks down into four sub categories:

High Income: South Korea

Upper Middle Income: Mexico, Turkey

Lower Middle Income: Egypt, Iran, Pakistan, Indonesia, Nigeria, Philippines

Low Income: Bangladesh, Vietnam

Jim has come up with a basket of indicators measuring the attractiveness of each country that includes liquidity of the financial system, bank deposits, central bank assets, private credit, stock market capitalization, outstanding currency, public and private debt, and for some countries, aid inflows. Before you rush out and load the boat with Egyptian names, let me tell you that investing in some of these places is easier said than done. This is really a call on economies, and not local stock markets...

Only a couple have ETF’s. with great success, South Korea (EWY) , Vietnam (VNM) and click here for more info on Vietnamese stock markets), and Indonesia (IDX) . Jim says that the best value for money in terms of financial development is Vietnam and Egypt....[ That's before the Muslim Brotherhood joined the Party...]?

In a few years you are going to become as weary of hearing about the N-11 as you are about BRIC’s today. To read the full eight page report from Goldman Sachs....

http://www.chicagobooth.edu/alumni/clubs/pakistan/docs/next11dream-march%20%2707-goldmansachs.pdf

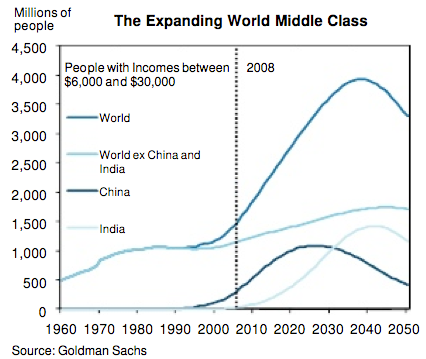

Move more money into emerging markets, take a look at the chart below from Goldman Sachs. It shows that the global middle class will rise from 1.8 billion today to 4 billion by 2040, with the overwhelming portion of the increase occurring in emerging markets...

The chart defines middle class as those earning between $6,000 and $30,000 a year. Adding 2.2 billion new consumers in these countries is creating immense new demand for all things and the commodities needed to produce them. This explains why these countries will account for 90% of GDP growth for at least the next ten years. It’s all a great argument for using this dip to boost your presence in ETF’s for emerging markets (EEM), China (FXI), Brazil (EWZ), and India (PIN).

Store this chart in your data base so when people ask why your portfolio is packed with Mandarin, Portuguese, and Hindi names, you can just whip it out.

The world is reaching a tipping point. For the past 40 years, global multinationals with unfettered access to capital, consumer, and labor markets have driven the world economy. There is now a new competitor on the scene, the “state capitalist,” where political considerations trump economic ones in the allocation of resources.

Of course, China is the main player, joined by several other emerging nations. The middle kingdom has posted double digit annual growth for the past 30 years without freedom of speech, economic rules of the road, and independent judiciary, and credible property rights.

China’s leadership is clearly worried that Western style freedoms will enable wealth to be generated outside their control and be used to orchestrate their overthrow. Private Western companies can only engage in transactions, which stand on their own economically and deliver the short-term profits, which their shareholders demand.

In China, long term political goals enable them to pay through the nose to obtain stable supplies of oil, gas, minerals, and materials. That keeps the country’s massive work force employed, off the streets, and politically neutered. The bottom line is that there are now two competing forms of capitalism. The recent financial crisis has accelerated their entrance to the global stage, moving us from a G7 to a G20 dominated world....

Globalization is not ending yet, but it is definitely entering a new chapter....

No comments:

Post a Comment